Before 1983, fewer than 10 treatments existed for rare diseases in the U.S. Today, more than 1,000 have been approved. The shift didn’t happen by accident. It was built on a single, powerful rule: orphan drug exclusivity.

What orphan drug exclusivity actually means

Orphan drug exclusivity is a seven-year period of market protection granted by the FDA to the first company to get approval for a drug treating a rare disease. It doesn’t matter if another company develops the exact same medicine. If you’re first to market, you get exclusive rights to sell it for that specific condition - no competitors allowed, unless they can prove their version is clinically superior. The law behind this is the Orphan Drug Act of 1983. It was created because pharmaceutical companies had little reason to invest in treatments for diseases affecting fewer than 200,000 people in the U.S. The cost to develop a drug can hit $1 billion. For a condition with only 5,000 patients, that’s a financial death sentence - unless the government steps in. That’s where exclusivity comes in. It’s not a patent. It’s a separate legal shield. Even if the drug’s chemical patent expires, the exclusivity stays. And unlike patents, which protect the molecule itself, orphan exclusivity protects the drug for one specific disease. So if a drug is approved for two conditions - one rare, one common - the company keeps exclusivity only for the rare one. The rest is open to generics.How the system works in practice

Here’s how it plays out on the ground. A biotech company identifies a rare genetic disorder. They apply for orphan designation with the FDA. The process takes about 90 days. Approval rate? Nearly 95%. Once designated, they can begin clinical trials with the knowledge that if they succeed, they’ll get seven years of market control. But here’s the catch: it’s a race. Multiple companies can apply for the same orphan designation. Only one wins. The first to get FDA approval gets the exclusivity. The others are locked out - unless they can show their version works better. And “better” isn’t just slightly better. The FDA requires a substantial therapeutic improvement. That could mean fewer side effects, better survival rates, or a new way to deliver the drug. Since 1983, only three cases have met this bar. Take the case of amifampridine. The drug was first approved for Lambert-Eaton myasthenic syndrome under the brand name Firdapse. Years later, another company got approval for the same drug under the name Ruzurgi. The FDA allowed it because the new version was formulated for a different age group (children), not because it was clinically superior. That sparked debate. Was this a loophole? Or was it fair? The FDA clarified its rules in 2023 to close some of those gaps.

Why this system works - and why it’s controversial

The numbers speak for themselves. Before 1983, just 38 rare disease drugs were approved in the U.S. Since then? Over 1,000. That’s a 26-fold increase. The Orphan Drug Act didn’t just help patients - it created a whole new industry. By 2022, orphan drugs made up nearly a quarter of global prescription sales - $217 billion. For small biotech firms, this is life or death. One executive told me: “Without exclusivity, we couldn’t justify spending $150 million to treat 8,000 people.” That’s not hyperbole. It’s the math. Without this protection, investors wouldn’t fund these projects. No one would take the risk. But there’s a dark side. Some big pharma companies have used orphan designations to extend profits on drugs that already made billions. Humira, for example, got orphan status for multiple rare conditions - even though it was originally developed for common autoimmune diseases. Critics call it “salami slicing”: cutting up a blockbuster drug into tiny patient groups to lock in exclusivity. Patient advocacy groups are split. A 2022 survey by the National Organization for Rare Disorders found 78% of groups say exclusivity is essential. But 42% worry about the prices that follow. Some orphan drugs cost over $500,000 per year. That’s not because of development costs - it’s because the market is small and protected. No competition means no pressure to lower prices.How it compares to other countries

The U.S. gives seven years. The European Union gives ten. And in Europe, companies can get a two-year extension if they test the drug in children. The EU also lets regulators shorten the period from ten to six years if the drug becomes wildly profitable - something the U.S. doesn’t do. That’s why some companies file for orphan status in both regions. They want the longest possible protection. But the rules aren’t interchangeable. A drug approved in the U.S. doesn’t automatically get the same protection in Europe. Each system has its own application process, data requirements, and approval timelines. In Japan and Canada, similar systems exist, but they’re less structured. The U.S. and EU are the only ones with clear, enforceable exclusivity periods tied directly to rare disease approval.

What sponsors need to know to win

If you’re a company trying to get orphan exclusivity, timing matters. Apply for designation as early as Phase 1 or Phase 2 of clinical trials. Don’t wait until you’re ready to file for approval. The designation gives you access to FDA guidance, fee waivers, and tax credits - all valuable. You also need to prove your disease meets the 200,000-patient threshold. That means solid epidemiology data. The FDA will ask for population studies, hospital records, genetic databases - anything that shows the disease is truly rare. If your data is weak, your application gets rejected. And you need to think ahead. Will your drug be used for other conditions? If so, plan your regulatory strategy carefully. You might want to keep the orphan designation for the rarest use - and let the common use go generic. That way, you protect your most profitable market without triggering backlash.What’s next for orphan drug exclusivity?

The system is under pressure. In 2023, the FDA proposed new rules to tighten the definition of “same drug” after the Ruzurgi case. The European Commission is considering cutting its exclusivity period from ten to eight years for drugs that become too profitable. But here’s the thing: the incentives work. The FDA approved 434 orphan designations in 2022 - up from 127 in 2010. By 2027, over 70% of new drugs are expected to have orphan status. That’s not a bug - it’s a feature. Rare diseases are no longer a neglected corner of medicine. They’re a growth engine. The real challenge isn’t whether exclusivity should exist. It’s how to make sure it serves patients, not just profits. That means better pricing controls. More transparency. And smarter rules that stop abuse without killing innovation. For now, orphan drug exclusivity remains the backbone of rare disease treatment. It turned a medical dead end into a thriving field. And for families waiting for a treatment that doesn’t exist yet - that’s everything.What is orphan drug exclusivity?

Orphan drug exclusivity is a seven-year period of market protection granted by the FDA to the first company to receive approval for a drug treating a rare disease - defined as affecting fewer than 200,000 people in the U.S. During this time, the FDA cannot approve another company’s version of the same drug for the same condition, unless the new version shows clinical superiority.

How is orphan exclusivity different from a patent?

A patent protects the chemical structure or method of using a drug, and typically lasts 20 years from filing. Orphan exclusivity protects only the specific disease indication, regardless of the patent status. It starts at FDA approval and lasts exactly seven years. Even if the patent expires, exclusivity still blocks competitors - unless they prove their drug is clinically superior.

Can multiple companies get orphan designation for the same drug?

Yes. Multiple companies can apply for orphan designation for the same drug and disease. But only the first one to get FDA approval wins the seven-year exclusivity. Others can still develop the drug, but they can’t get approval for that indication unless they prove their version is clinically superior - a very high bar that’s been met only three times since 1983.

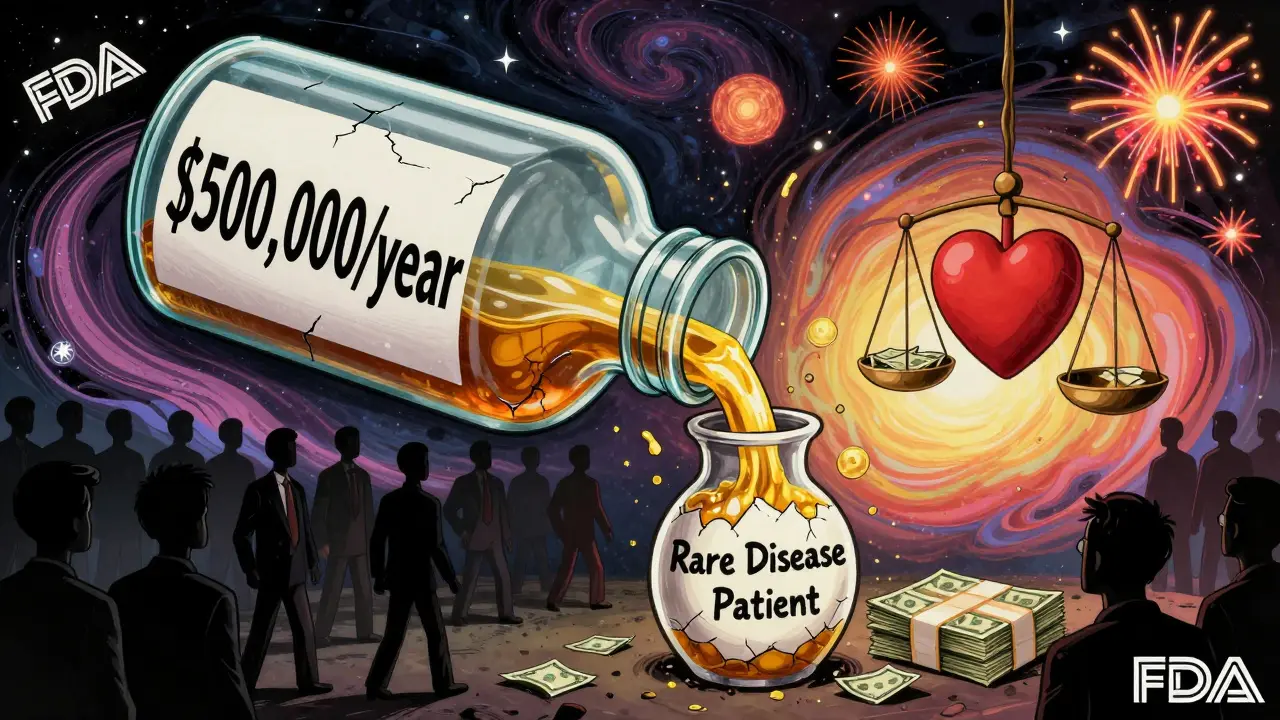

Why do some orphan drugs cost so much?

Because the patient pool is small and protected from competition, companies can set high prices to recover development costs. A drug for 5,000 patients can’t rely on volume sales. So it may cost $500,000 a year per patient. While exclusivity encourages development, it also removes price pressure - leading to ethical debates about affordability and access.

Is orphan exclusivity only available in the U.S.?

No. The European Union offers ten years of exclusivity, with possible extensions for pediatric studies. Japan and Canada have similar programs, but they’re less formalized. The U.S. and EU systems are the most established and widely used. Companies often seek orphan status in both regions to maximize protection.

What happens if a drug is approved for both a rare and common condition?

The orphan exclusivity applies only to the rare disease indication. For the common use, other companies can develop and sell generic versions. This is why some companies strategically file for orphan status on a less common use of a drug - to protect that specific market while allowing generics in the broader one.

How do companies apply for orphan drug designation?

Companies submit an application to the FDA’s Office of Orphan Products Development, typically during early clinical development. The application must prove the disease affects fewer than 200,000 people in the U.S. and that the drug shows promise for treating it. The FDA reviews applications in about 90 days and approves around 95% of properly submitted requests.

What are the biggest criticisms of orphan drug exclusivity?

Critics argue it’s being abused by large pharmaceutical companies to extend monopolies on blockbuster drugs through “salami slicing” - applying for multiple orphan designations for minor variations of the same drug. Others say pricing is unjustifiably high, and that the system doesn’t always ensure drugs reach patients who need them. Regulatory agencies are now reviewing how to prevent misuse while preserving incentives for innovation.

saurabh singh

January 4, 2026 AT 04:09Man, this orphan drug thing is wild - in India, we don’t even have access to half these drugs, let alone afford them. But I get it - no exclusivity, no innovation. Still, when a pill costs more than my car, something’s off.

Catherine HARDY

January 5, 2026 AT 22:37They say it’s for patients… but who really benefits? Big Pharma’s been quietly buying up small biotechs just to grab orphan status - then jacking up prices. It’s not a loophole, it’s a system designed to be exploited. You think the FDA doesn’t know? They do. They just look away.

bob bob

January 6, 2026 AT 20:05Just want to say - this system saved my sister’s life. She has a rare neuromuscular disorder. Without Firdapse, she wouldn’t be walking. Yeah, it’s expensive, but if this is what it takes to get treatments for people like her? I’ll take it. The system’s flawed, but it’s not evil.

Vicki Yuan

January 7, 2026 AT 07:46It’s fascinating how the Orphan Drug Act created an entire ecosystem - from tax credits to FDA guidance - that incentivizes development without compromising scientific rigor. The 95% approval rate for orphan designation isn’t a flaw; it’s a feature designed to lower barriers for small players. And yes, pricing is problematic, but that’s a separate policy issue, not a failure of the exclusivity model itself.

Uzoamaka Nwankpa

January 8, 2026 AT 16:54Every time I see one of these drugs priced at half a million dollars, I think of my cousin who died waiting for a treatment that never came. The system doesn’t care about the ones who don’t make it to the finish line. It only cares about the ones who can pay.

Chris Cantey

January 10, 2026 AT 11:33Think about it - we’ve created a world where the value of a human life is measured in patient counts. If you’re under 200,000, you’re worthy of a cure. If you’re over? You’re just a statistic. The real tragedy isn’t the price tag - it’s the moral calculus that got us here.

Abhishek Mondal

January 10, 2026 AT 12:54Wait - let me get this straight: a drug can be approved for two indications - one rare, one common - and the company gets exclusivity ONLY for the rare one? That’s not a loophole - it’s a legal fiction! And the FDA’s 2023 clarification? Too little, too late. This is corporate gaming at its finest. Who’s really benefiting? Not patients. Not science. Just shareholders.

Oluwapelumi Yakubu

January 11, 2026 AT 06:05Look, I ain’t no economist, but I’ve seen the math - when you’ve got 5,000 people and a $150M bill, you gotta charge like you’re selling gold-plated oxygen. But here’s the twist: the real innovation isn’t the drug - it’s the paperwork. The real genius is filing for orphan status before Phase 1, not curing disease. That’s the new frontier of biotech - regulatory arbitrage, baby.

Terri Gladden

January 12, 2026 AT 19:30OMG I just read this and I’m crying!! This is so important!! Like, imagine if your kid had a rare disease and there was NO treatment?? But then… why is it so expensive?? And why does Big Pharma get to do this?? I feel so conflicted!! Someone please explain!!

Jennifer Glass

January 14, 2026 AT 14:55It’s interesting how the system works on incentives rather than mandates. The government didn’t force companies to develop orphan drugs - it created a structure where doing so became the rational choice. That’s smart policy. The problem isn’t the mechanism - it’s the lack of downstream controls on pricing and access. Fix those, and you preserve innovation without moral compromise.

Joseph Snow

January 16, 2026 AT 08:11This entire framework is a sham. The FDA approves 95% of orphan designations? That’s not a rigorous gate - it’s a rubber stamp. And the fact that companies are gaming it by repurposing blockbuster drugs into ‘orphan’ indications? That’s not innovation - it’s regulatory fraud. The system is broken, and pretending otherwise is dishonest.

melissa cucic

January 18, 2026 AT 02:22While the Orphan Drug Act has undeniably increased therapeutic options for rare diseases, its unintended consequences - namely, the concentration of market power, the absence of price transparency, and the perverse incentive to fragment indications - require urgent recalibration. A ten-year exclusivity period in the EU, coupled with profitability thresholds, may offer a more balanced model than the U.S.’s rigid seven-year framework.

Akshaya Gandra _ Student - EastCaryMS

January 19, 2026 AT 13:26wait so if a drug is for a rare disease but also works for a common one… they can just use the rare one to block competition? but then the common one is open? so like… they’re kinda cheating? but also… it’s legal? this is so confusing 😅

en Max

January 21, 2026 AT 08:44From a regulatory science standpoint, the orphan drug exclusivity mechanism represents a classic example of incentive-based policy design, wherein the state mitigates market failure by conferring temporary monopoly rights contingent upon the treatment of a condition falling below a predefined epidemiological threshold. The efficacy of this model is empirically validated by the 26-fold increase in approved orphan therapeutics since 1983. However, the conflation of market exclusivity with cost recovery - particularly in cases where R&D expenditures are disproportionately low relative to pricing - introduces ethical and economic externalities that necessitate tiered pricing frameworks and post-market surveillance protocols to ensure equitable access.